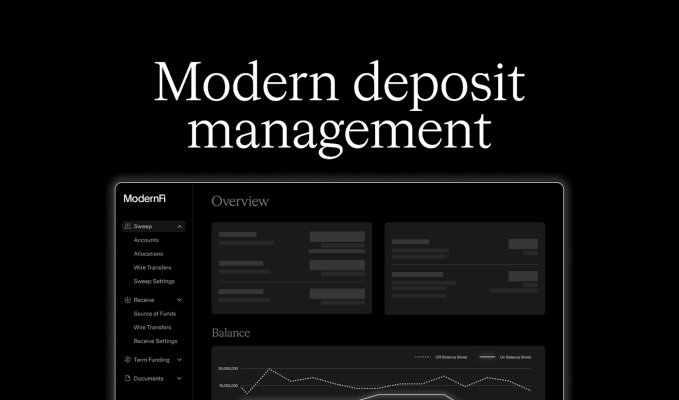

A lot has happened in banking over the past year, including the Silicon Valley Bank collapse, and that’s enabled companies like ModernFi to step in and provide other solutions.

The company provides community and regional banks with end-to-end deposit management capabilities, including a deposit network so bank customers can grow, retain and manage their deposit base by sourcing deposits, sweeping funds and providing additional security to depositors.

In fact, ModernFi, founded in 2022 by Paolo Bertolotti and Adam DeVita, raised $4.5 million in a seed round a month prior to the SVB news.

“After SVB, after Signature and after First Republic, a lot of those institutions came together and said, ‘We need a better solution here. We don’t think regulators are going to make changes, and we don’t think that the current solutions or the current incumbents have moved fast enough to support this,’” Paolo Bertolotti, co-founder and CEO of ModernFi, told TechCrunch. “Fortunately, some of the Canapi Ventures’ folks were in those discussions, and they knew about us, so we started talking.”

That continued relationship eventually led to a new funding round that ModernFi announced today of $18.7 million in Series A funding.

Canapi Ventures led the round and was joined by Andreessen Horowitz, Remarkable Ventures and a group of banks including Huntington National Bank, First Horizon and Regions. In total, the company has raised over $23 million in venture capital.

Bertolotti labeled 2022 and 2023 as “unique and pretty substantial” years, citing rising interest rates that resulted in “some of the most aggressive deposit runoff in history,” along with SVB and others collapsing.

“You’re left with a situation that disproportionately impacted small and mid-sized banks,” he said. “On this whole notion of deposit growth, retention management became first, second and third priority for a lot of institutions. We were very fortunate to be in a position to help deposit networks and institutions weather that storm and continue their growth and trajectory.”

ModernFi makes money from basis points based on deposits in the network, and Bertolotti said 2023 was “a very good year,” but declined to go into specifics beyond that. Between the seed and Series A rounds, the company doubled its headcount, and the number of institutions supported “has grown very meaningfully.”

Meanwhile, the new capital will be invested in growth — the team and organizational structure. Bertolotti plans to grow in engineering, new product development, compliance and regulatory adherence and in business development. Some of that product development will include more integrations and API development.

“We will expand and double down on those initiatives while also making sure that our analytics suite is very fully functional,” Bertolotti said. “We’re also doing some work on asset liability management and account level deposit analytics, so there’s a huge range of features and products that we’ll be working on. The larger goal is to support the entire lifecycle and workflow for bank CFOs. It’s a huge undertaking, but it’s a path that we’re very excited about.”