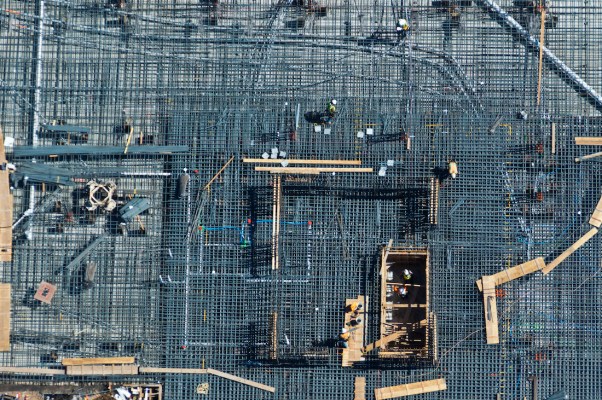

Bulk Exchange, a startup building a marketplace that lets construction companies and contractors buy and dispose materials in bulk, has raised $4.5 million in seed funding.

Instead of heading down the traditional venture capital avenue, the company instead raised the majority of its funding from people in the construction industry, its CEO and co-founder, Paul Foley, told TechCrunch. Bulk Exchange’s chief strategy officer Rachel Mahoney also noted that the company employed convertible notes to raise the capital.

It’s not surprising that the startup looked to the industry it’s serving for the funding: They likely want to use what it’s building.

I interviewed Foley over video for this story, and he succinctly illustrated the need for his company’s product by gesturing toward a cork board that was plastered with sheets — that’s how how most folks in the business today source the gravel and sand that underpin construction work around the world, he said.

Tech startups often find the most traction by simplifying or addressing a large, critical and recurring business process that’s executed with paper or spreadsheets, so Bulk Exchange is following a well-trodden path. Still, construction isn’t an industry most people think of when you talk about tech — indeed, Bulk Exchange is the first startup that I’ve heard of that’s tackling this particular niche.

Niche or not, this is not a small market. Quarries, dump sites and the goods that they supply, or facilitate the removal of, are worth hundreds of billions of dollars. Building a marketplace for those sales could generate material revenues, in other words.

And that is what Bulk Exchange is working on: a digital space where suppliers and dumpsites can link up with contractors and estimators to quickly source what they need and buy it. This is a two-part task. First, estimators employed by contractors have to sort out the costs for a project their firm might want to bid on. But that requires knowing the costs for the input materials for that work, so if you don’t have local contacts, this can take lots of time. If Bulk Exchange can get enough providers on to its platform, estimators may be able to execute their work more quickly.

Second, once contracts are signed, Bulk Exchange can convert estimates into sales by linking buyers and sellers on the platform.

The company doesn’t intend to take a cut of the transactions it helps execute, since, as Foley and Mahoney explained to me, such cuts are considered unpalatable in their industry. Construction projects yield thin margins, which makes paying a percentage-cut of bulk purchases to a third-party unwelcome. Instead, Bulk Exchange intends to charge for its services similar to a SaaS model.

The company’s revamped website and now-live marketplace offering are potentially just its first steps. When I asked Mahoney if Bulk Exchange had plans to aggregate and sell data access to the data that its platform generates, she agreed that there are big opportunities for such a product, given that the information that the startup’s platform will generate is effectively impossible to source today. If Bulk Exchange can scale and collect lots of data, it could have a second business and revenue stream in time.

Bulk Exchange’s service is live, and it has cash in the bank. Let’s see how much sand and gravel it can help move.